Every once and a while I catch myself calculating how much $1.50 will be worth if invested for 15 years and realize I need to put the calculator down. It comes to $2,081.19 if you saved $1.50 each week at 8% interest for 15 years. Doesn’t seem like a lot but if you could save $1.50 a day (one cup of coffee) it comes out to $15,576.68. See here I go again.

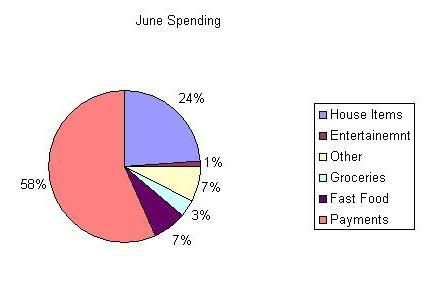

Anyway, on to June. Like I said I am trying to keep it simple. Below is our pie chart of spending for the month. You’ll notice there isn’t a slice for savings this is because we’ve put everything we have into paying off the cards since we are so close. As soon as they are paid off in the next few months we will begin our retirement savings and emergency fund.

The categories are as follows:

House Items

- House payment (insurance & taxes included)

- Gas

- Water/electric

- Alarm system

Entertainment

- Our monthly personal allowance

- Entertainment fund allowance

Other

- Cell phone

- Cable

- Gas

Groceries

- Groceries (including animal food and & health/beauty spending)

Fast Food/ Eating Out

- Fast Food

- Other eating out expenses (this month only)

Payments

- Student loans

- Credit Card

Obviously we did some things well and others not so much. We actually do have some very small savings but I chose not to list it since it isn’t for an emergency fund or retirement. Each month we put a designated amount into certain funds (personal, entertainment, gas, electric/water, gifts etc) but we don’t always spend that full amount leaving extra. For example in June we put $25 in our gift fund but only spent $12 so that is the amount I’ve listed.

This system works very well for us with our gas and electric bills. In the summer these two bills are greatly reduced but we continue to put a set amount of money in their “fund” creating a surplus. In the winter when the bills are increased our budget isn’t left hurting because we had to come up with extra money, we just use the additional money.

So the good and bad:

Things we did well in June

- I’m very happy with how much money we were able to put on our credit cards. I look at that huge slice of pie and realize in just a few more weeks that will be for savings not spending (less my student loans).

- We only spent 1/3 of our personal/entertainment money for the month. This is a first for us. Normally by now it would be gone.

- Our grocery spending is decreasing each month as I shop at CVS and use coupons. We were under budget for the month by $16.50. Not a lot but it’s a start since we normally go over in this area.

Things we didn’t do so well

- While I think its less than usual we did spend a lot of money on eating out. This is the first month I started tracking just how much of our money we were giving to McDonalds and Taco Bell, needless to say I’m not happy about it. I always knew we were spending too much in this category by I just didn’t realize how much. Just this month alone we’ve spent $128.85 on fast food places. We spent another $160 on eating at restaurants mostly for Fathers day. That’s a total of $288.85. ($100,611.40 over 15 years – Sorry I can’t resist)

How will we fix it?

- Fast Food Spending: I plan to continue to track how much we spend on fast food each month in hopes it will make us realize just how much money we’re giving away. Also most of the $160 we spent was on taking the fathers out to celebrate Father’s day. Obviously this is a once a year expense. We also spent a little on dinner with a friend who is moving out of state soon. All things we shouldn’t encounter again next month. Also during our last grocery trip I purchased some deli meat and plan to start packing my lunch for work. Therefore; even when I have to work nights I won’t be tempted to head out for food. Our goal next month is to reduce this spending to $100 or less. We’re trying to be rational and realize it won’t go to $0 overnight.

- In order to reduce cost we’ve made a few changes to how we run our household which I’ll be highlighting throughout the month. One change we made for instant savings was reducing our cell phone plan. We gained about 100 anytime minutes but lost unlimited texting (1000 per phone is plenty). We don’t have a home phone which is why we have a larger cell phone plan, as it’s still cheaper. We also only have texting because Matt needs it for work and the cost is supplemented by his boss; although, I will admit I’ve learned to rather enjoy it.

- I’m also considering shutting off our home alarm, but haven’t made a decision at this point. We don’t live in the best area, especially in this economy, but we’d save $50 a month by shutting it off. If we did shut off the system we could still set the alarm and it would alert us and the neighbors by a load annoying buzzer if someone did break in. With this option we would lose the feature of automatic 911 contact in the case of alarm; although last time I accidentally set it off it took them over 5 minutes to call and check. I’m sure I’d be dead by then. We’ll just wait and see what the next month brings. $50 isn’t too much to pay for our safety as long as it’s doing what it should be.

Overall, I’m happy with June. This is the first month we really kept track of our expenses and I thought it would be much worse. We definitely have room for improvement, and now that we know that we can work on it.

I also updated our net worth – no big changes.

How was your spending in June? Feel free to leave a link.

0 comments:

Post a Comment